While we're working on the finishing touches for the exciting new credit card program, dates previously communicated within your letter have changed. Your existing card will remain active so you can continue to enjoy all of its features and benefits and use the card to make purchases or transactions. You should receive your new card in Summer 2023.

If you have questions related to your new card, please visit our FAQ.

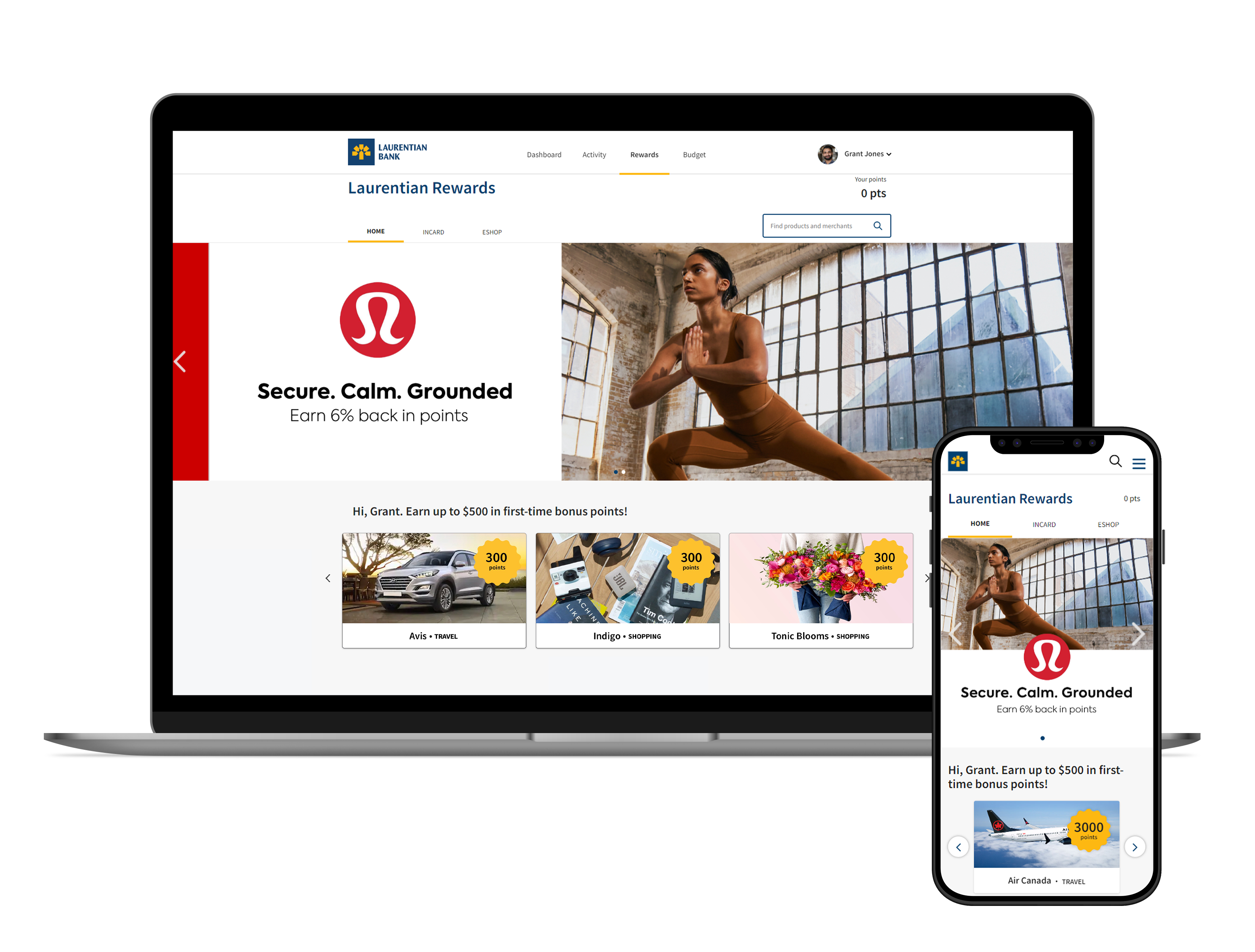

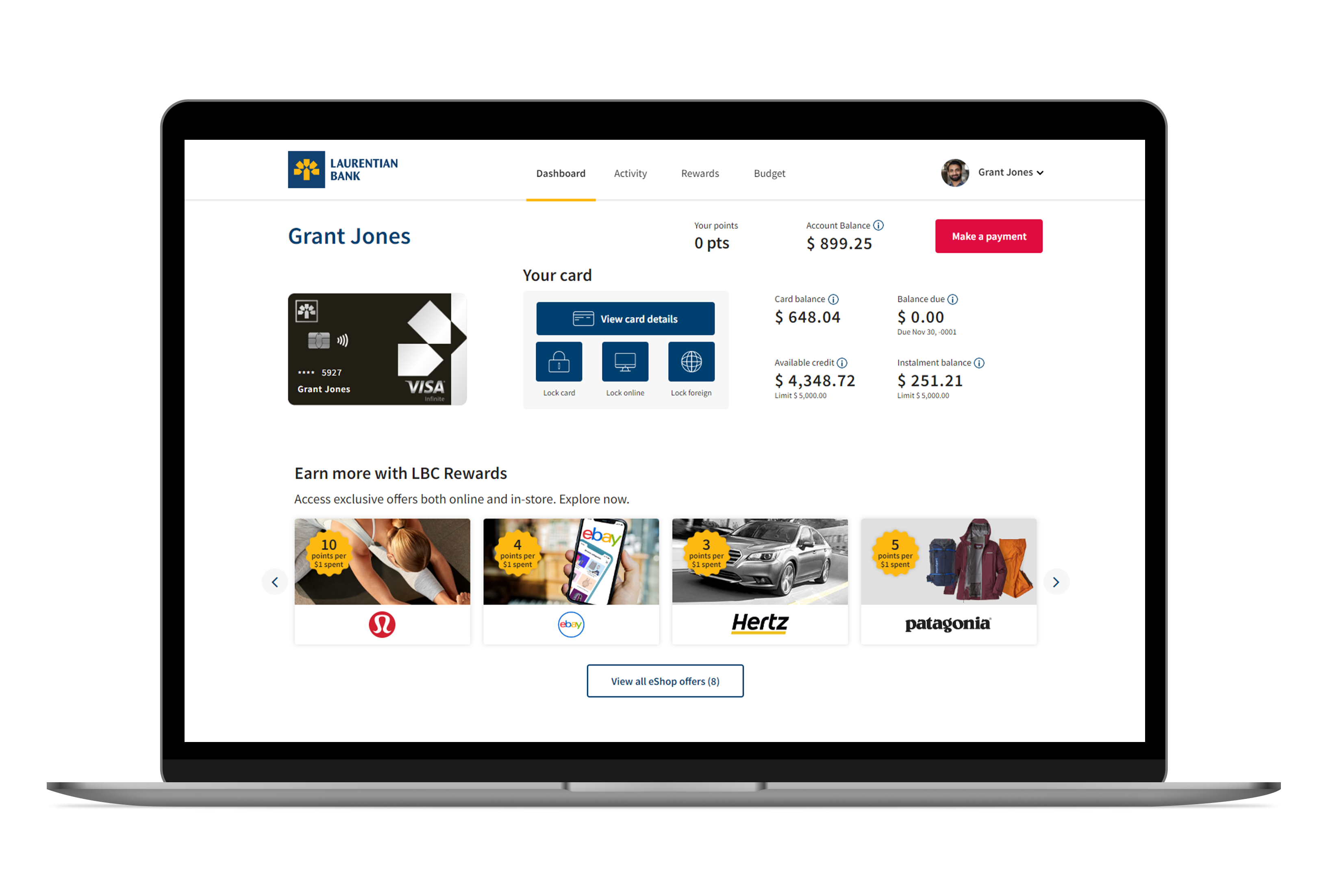

Your Laurentian Bank credit card experience is about to get even better. We’ve enhanced your online experience, making it easier for you to manage your account and rewards. You’ll also get access to unique offers to help you earn more.

New Digital Features

Maximize your earning power1

Flexible Payments2

- Access your transactions and account balance in real-time.

- View your rewards balance and easily redeem it against a specific purchase or towards your account balance.

- Manage your spending by category with the interactive budget tool.

- Instantly lock and unlock your card and block transactions in foreign currency.

- Avoid surprises with real-time notifications3 to keep track of purchases and quickly identify any fraudulent activity.

- Add authorized users, view their transactions, lock their card or block specific transactions, and set monthly spending limits for each cardholder.

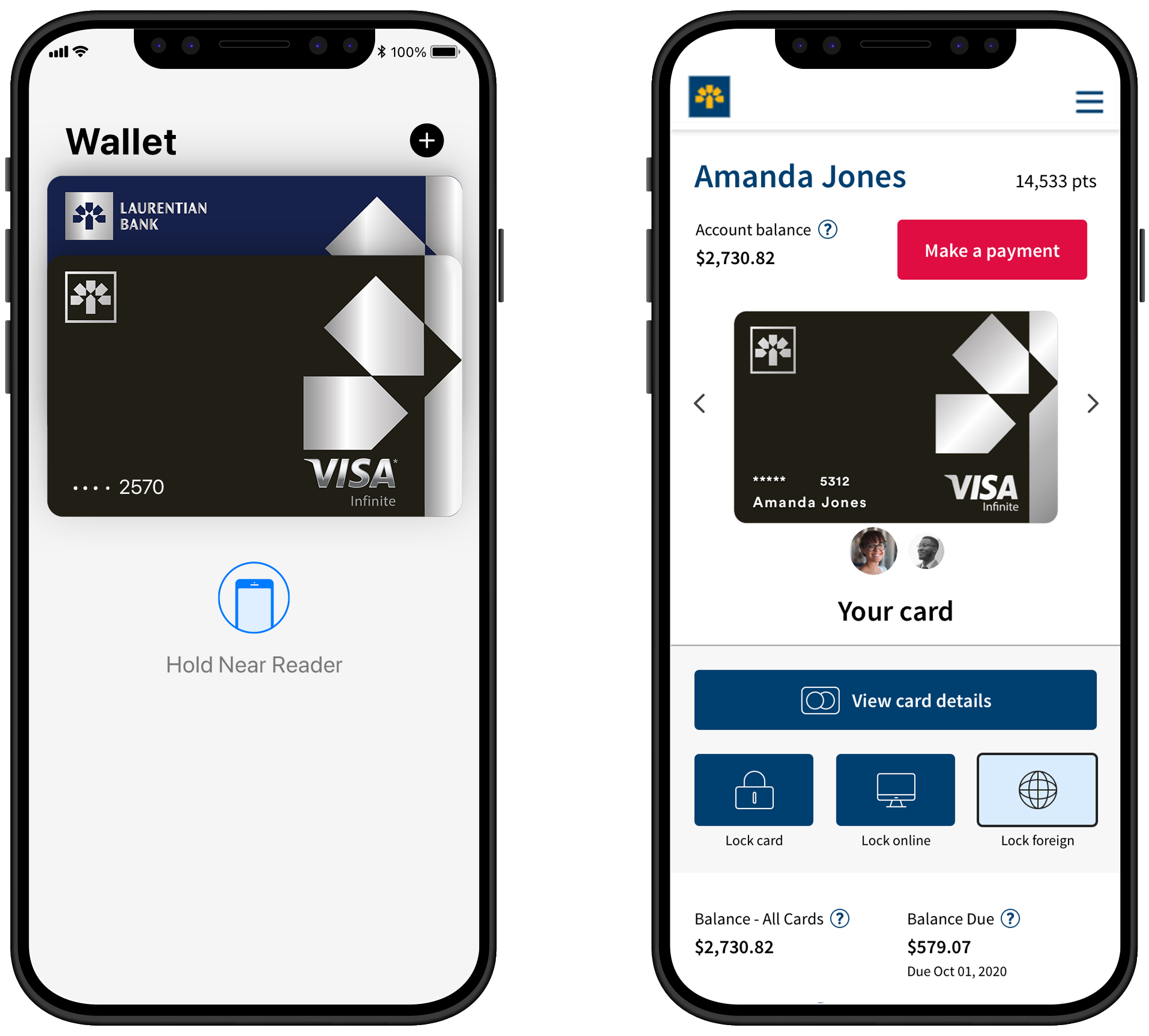

Contactless payments.

Upload your card to your mobile wallet and pay quickly and securely for your purchases.

Our new Laurentian Bank Visa* credit cards.

Laurentian Bank Visa Infinite* card

Annual fees: $1304

Interest rate on purchases: 20.99%5

Interest rate on purchases: 20.99%5

2 points on Recurring Payments.

2 points on Gas, Grocery, Travel and Transportation.

1 point on other Eligible Purchases.

2 points on Gas, Grocery, Travel and Transportation.

1 point on other Eligible Purchases.

Earn additional rewards on special merchant offers. See details in Laurentian Bank Rewards program agreement.

To find out more about the changes to your Visa Cashback card, please refer to this document.Learn more

Laurentian Bank Visa* Cashback card

Annual fees: $654

Interest rate on purchases: 20.99%5

Interest rate on purchases: 20.99%5

2% on Recurring Payments.

2% on Gas and Grocery.

1% on other Eligible Purchases.

2% on Gas and Grocery.

1% on other Eligible Purchases.

Earn additional rewards on special merchant offers. See details in Laurentian Bank Rewards program agreement.

To find out more about the changes to your Visa Cashback card, please refer to this document.Learn more

Laurentian Bank Visa*

Reward Me card

Annual fees: No fees4

Interest rate on purchases: 20.99%5

Interest rate on purchases: 20.99%5

1 point on Recurring Payments.

1 point on Gas and Grocery.

0.5 point on other Eligible Purchases.

1 point on Gas and Grocery.

0.5 point on other Eligible Purchases.

Earn additional rewards on special merchant offers. See details in Laurentian Bank Rewards program agreement.

To find out more about the changes to your Visa Reward Me card, please refer to this document.Learn more

Laurentian Bank Visa*

Reduced Rate card

Annual fees: $304

Interest rate on purchases: 12.49%5

Interest rate on purchases: 12.49%5

Earn rewards on special merchant offers. See details in Laurentian Bank Rewards program agreement.

To find out more about the changes to your Visa Reduced Rate card, please refer to this document.Learn more

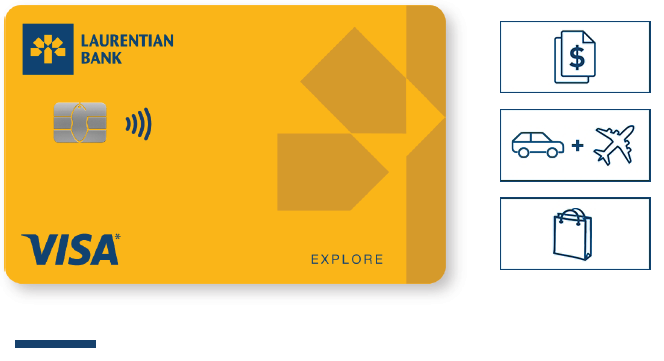

Laurentian Bank Visa* EXPLORE card

Annual fees: $1104

Interest rate on purchases: 20.99%5

Interest rate on purchases: 20.99%5

2 points on Recurring Payments.

2 points on Travel and Transportation.

1 point on other Eligible Purchases.

2 points on Travel and Transportation.

1 point on other Eligible Purchases.

Earn additional rewards on special merchant offers. See details in Laurentian Bank Rewards program agreement.

To find out more about the changes to your Visa EXPLORE card, please refer to this document.Learn more

Choose the card

that suits you best.

Compare all the cards

Your new credit card is coming soon!

You’ll be receiving your new Laurentian Bank credit card in the mail with instructions for online activation. Once you activate your card, you can start using it right away.If you have questions, we have answers.

Learn more about your new credit card.

Go to Help and FAQ

Documents and Agreements

Legal Notice

*Trademark of Visa Int., used under license.Capitalized Terms not defined in this page have the meaning ascribed to them in the Agreement Governing the Use of the Laurentian Bank Visa Card, as updated.

- For full details on the terms and conditions that apply to the Rewards Program, you can simply refer to the Rewards Program Agreement.

- The Instalment Plan allows the Eligible Cardholders to pay under certain conditions, Eligible Purchases in equal and consecutive monthly payments (including interest) over a fixed Payment Period. You determine the duration of Your Payment Period (in months) and the annual interest rate that will apply is the annual rate of interest corresponding to the selected Payment Period. Eligibility criteria apply: You are an Eligible Cardholder, Your Account must be in Good Standing, Purchases must qualify as an Eligible Purchase. For full details on the terms and conditions that apply, please refer to the update to the Agreement Governing the Use of the Laurentian Bank Visa* Card provided to You with the letter.

- The Bank attempts to deliver messages from the publisher in the order they are published. However, network issues could potentially result in out-of-order messages. It is recommended to check the timestamp attributed to the transaction to check for out-of-order messages.

- Annual fees are not Refundable. For more information, consult the document entitled “Information Box’’ in the Cardholder Agreement.

- Subject to change and credit approval by Laurentian Bank. For more information about the Laurentian Bank Visa card, including information about the credit rate, the grace period, charges other than interest or the date on which interest applies, consult the document entitled “Information Box’’ in the Cardholder Agreement.