My 100% Advice bank • March 06, 2020

modified on June 11, 2021

COVID-19 and market volatility

Risk or opportunity?

The events of the past few weeks have taken a toll on stock markets worldwide, resulting in a significant pullback over the past several days. How should you react to fluctuations in the market?

As the mainstream media emphasize dips in the stock market, keep in mind that your fund managers continually monitor your savings and optimize their strategies to address changing economic conditions. You can always reach out to your advisor to talk this process through. Occasionally, situations of this type can represent an opportunity to achieve your goals more quickly.

Some tips to guide you through times of economic uncertainty:

- Ignore market noise

Losses on shares only materialize when you succumb to panic and sell off your positions. - Stay focused on the long term

When bear markets do occur, they are intense and short-lived. Over the long term, the current volatility will pass. Downturns, corrections and even bear markets are normal features of stock market cycles. - Avoid panic selling

Investor overreaction is typically motivated by fear and is responsible for the biggest investment mistakes. If you have any questions about the current situation, talk them through with your advisor and take another look at your investor profile and portfolio. Your advisor is a professional who is capable of combining an understanding of your goals with a comprehension of market realities. - There are bargains on the markets

As the legendary Warren Buffet once said, "Be fearful when others are greedy and greedy when others are fearful."

The current virus isn't the first and won’t be the last.

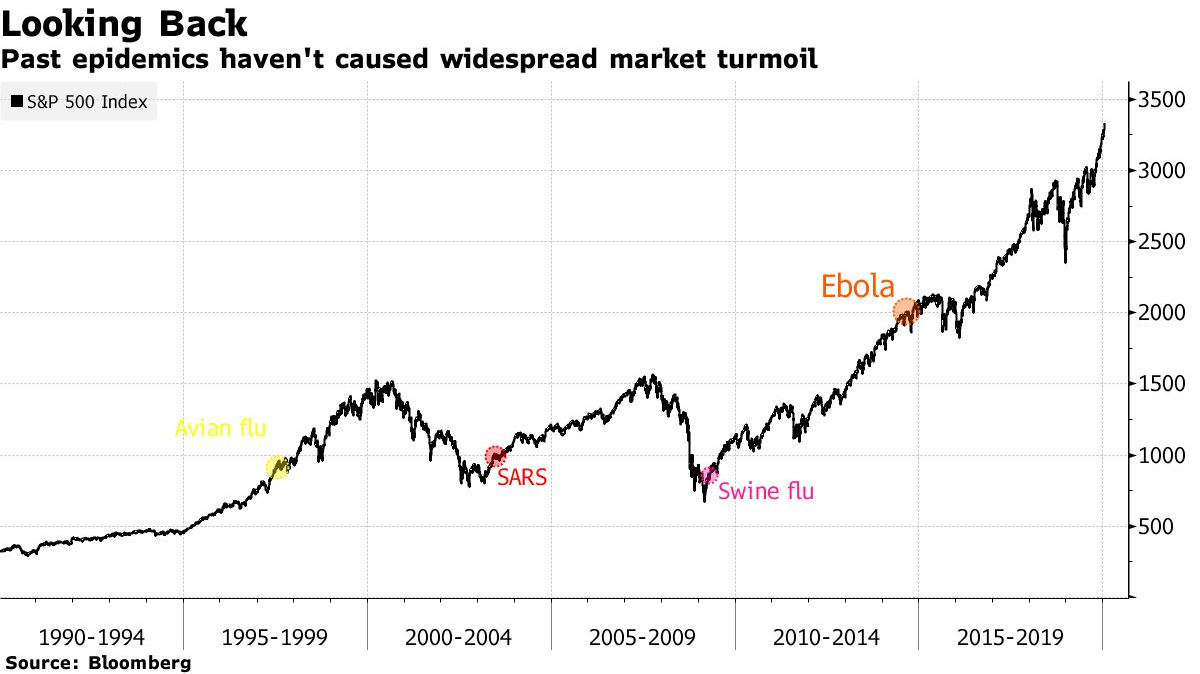

Four other events have raised global health concerns over the past 20 years. In each instance, an initial period of panic is followed by concerted action undertaken by world governments and a gradual return to normal. As this graph demonstrates, the effects of these unfortunate episodes fade over time:

If you have any questions, talk them over with your advisor.

LBC Financial Services firm team Inc.

+ Legal Notices

The articles on this website are for information purposes only. They do not create any legal or contractual obligation for Laurentian Bank and its subsidiaries.

These articles do not constitute financial, accounting, legal or tax-related advice and should not be used for such purposes. Laurentian Bank and its subsidiaries may not be held liable for any damage you may incur as part of such use. Please contact your advisor or any other independent professionals, who will advise you as needed.

The articles may contain hyperlinks leading to external sites that are not managed by LBC. LBC cannot be held liable for the content of such external sites or the damage that may result from their use.

Prior written consent from the Laurentian Bank of Canada is required for any reproduction, retransmission, publication or other use, in whole or in part, of the contents of this site.