Invest in your dream future.

Laurentian Bank advisors are here to help you get there.

Take advantage of our extended opening hours and meet with an advisor to contribute to your RRSP.

Plan today for a better tomorrow!

Laurentian Bank advisors are here to help you plan your retirement.

Planning for retirement

Planning for retirement is more important than ever. Yet, many Quebecers simply aren’t planning well enough to secure the income they need to sustain their lifestyle and make for a comfortable retirement.

To fully enjoy your retirement, it’s important to plan it as early as possible with the right strategy that aligns with your priorities, future projects and current savings capacity.

- Why should you plan for retirement?

- To feel financially secure and confident

- To focus on your priorities and achieve your long-term financial goals

- To achieve financial independence and a successful retirement

Some important numbers

- 8 million Canadians will be over 65 by 2026, representing 20% of the total population.

- The number of people reaching age 100 has increased by 36% since 2015.

- The average age of retirement is 63.

- The average life expectancy is 87-89 years. This means that many people can expect to spend 25+ years in retirement.

+ When should you plan your retirement?

+ What are the potential sources of income in retirement?

+ What happens during your meeting with a Laurentian Bank advisor?

- Identifying your sources of retirement income and financial objectives with you

- Performing the necessary calculations to determine if your current savings are sufficient

- Suggesting the most appropriate savings vehicles for your situation and risk tolerance

- Discussing with you how you would like to retire to better prepare you mentally and financially

+ Are you planning your retirement as a couple?

+ What kind of transition to retirement do you want and what disbursement strategy should you have?

A disbursement plan established with your advisor has several benefits and allows you to maximize your income, reduce your tax liability and ensure a gradual transition of your growth investment portfolio to generate a stable income. Over how many years should you plan to withdraw money from your RRSP? When is the best time to convert your RRSP to a RRIF? Should you delay the Quebec Pension Plan and the Old Age Security pension? How about consolidating your assets in the same financial institution? These are just a few of the questions that will be answered as part of your disbursement strategy.

Remember to review your disbursement plan annually, especially if your situation changes.

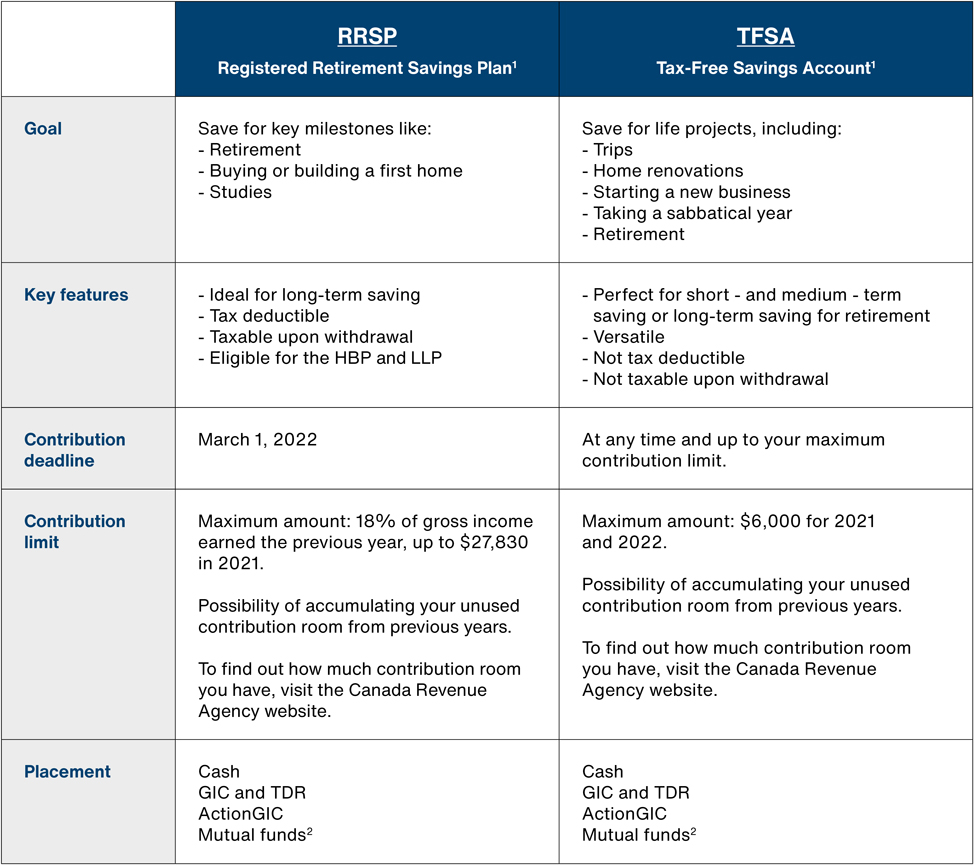

RRSP or TFSA?

A simple question that can raise a lot of other questions!

To make your decision easier, use one of your savings goals as a starting point.

If you’re looking to save for retirement, buying a home, renovations or to build an emergency fund, it might be better to opt for an RRSP. But if you want to save for a trip or home renovations, a TFSA may be your best bet.

Since every situation is unique, meet with a Laurentian Bank advisor to discuss RRSPs and TFSAs and figure out the best solution for you.

+ Discover RRSP and TFSA features:

Investment solutions

At Laurentian Bank, we have several solutions to help you save. Depending on your savings goals, life priorities and investor profile, our advisors will help you establish a personalized investment strategy adapted to your situation and aspirations. They will then recommend the registered plans, investment products and financing options that are best for you.

INVESTMENT

GIC, ActionGIC, mutual funds

GIC

Guaranteed Investment Certificates3 (GICs) are investments that offer a guaranteed rate of return over a fixed and pre-determined period of time.

+ Features

- Fixed return regardless of market fluctuations

- Several terms offered depending on the investment horizon

- Possibility of investing it in a registered plan, such as an RRSP or TFSA

- Low level of risk

- Protected initial investment

ActionGIC

ActionGICs4 allow you to take advantage of market performance and greater growth potential than a conventional GIC, while guaranteeing 100% return of capital.

Mutual funds

A mutual fund2 is an investment group (made up of stocks, bonds or other securities) that is managed by a professional portfolio manager. When you invest in a mutual fund, you pool your money with other investors. Your capital is not guaranteed, but there may be a higher return potential depending on market fluctuations.

Did you know that you could invest responsibly with the Mackenzie Global Women’s Leadership Fund, the Mackenzie Global Environmental Equity Fund and the Mackenzie Global Sustainability and Impact Balanced Fund in the Laurentian Bank mutual funds range?

+ What is an ESG fund?

An ESG fund is an ethical fund based on an in-depth analysis of the companies it’s composed of, including their risk management and their societal and environmental impacts. ESG refers to environmental, social and corporate governance factors. Although they have existed for more than a decade, the public’s interest in this type of fund is growing as it encourages responsible investment, unlike other, more traditional mutual funds whose main selection criteria is profitability.

The ESG fund brings together companies that work in, among other things, green and renewable energies, or that encourage healthy working conditions and/or the presence of women on boards of directors. These criteria help minimize risk and can, therefore, generate stronger returns compared to portfolios that fail to take these criteria into account.

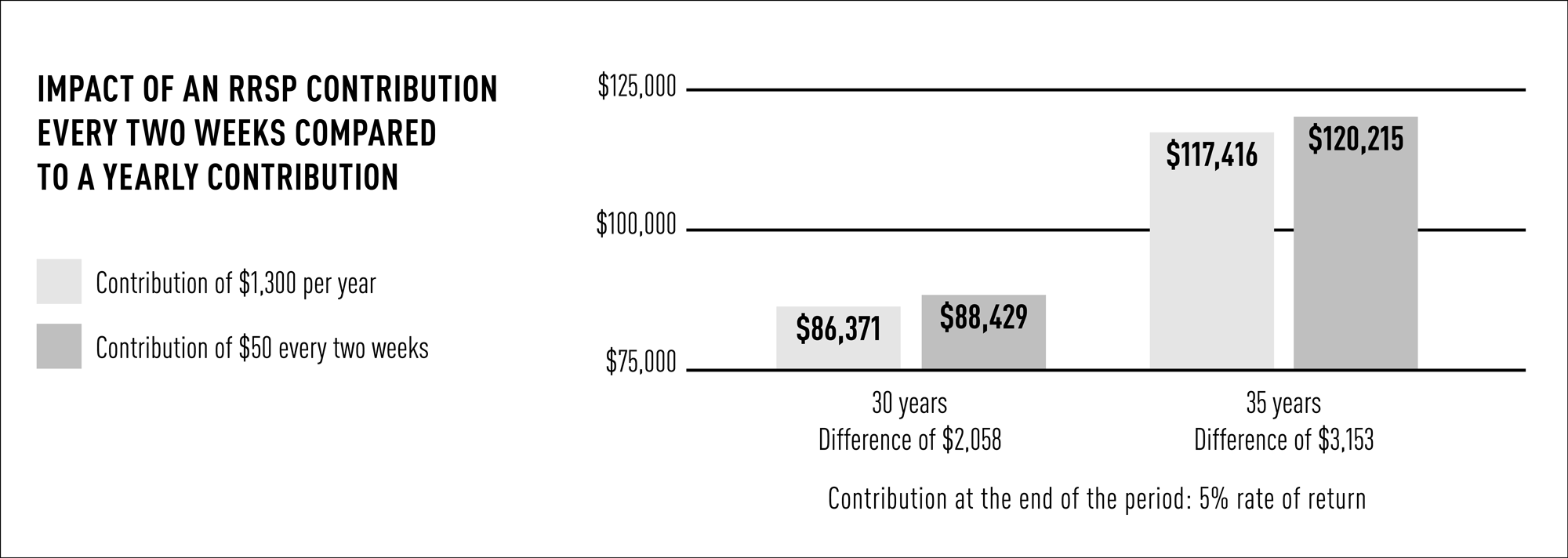

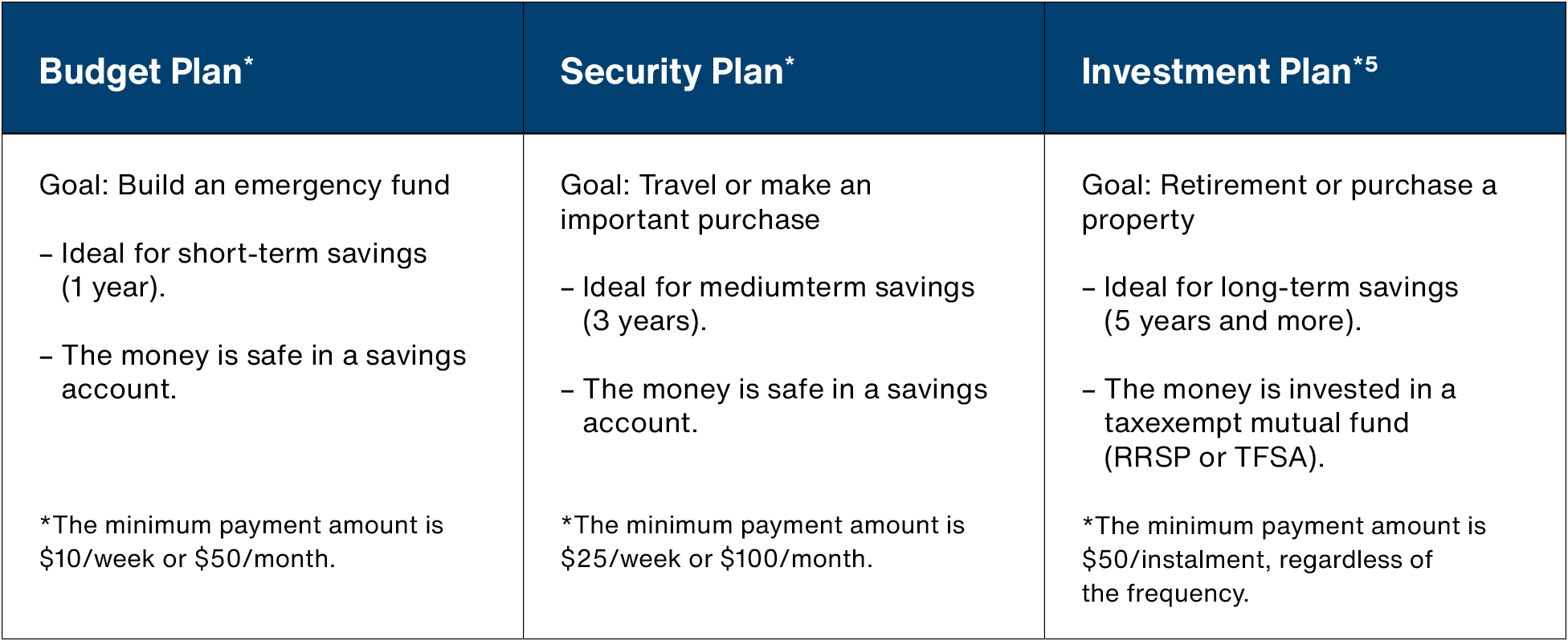

THE PERIODIC SAVINGS AND INVESTMENT PLAN (PSIP)

Budget Plan, Security Plan, Investment Plan

The PSIP is a saving solution that helps you adopt good saving habits, allowing you to put money aside on a regular basis without having to think about it. Together with an advisor, you can determine the amount you want to save and then establish the frequency of your payments (weekly, monthly, etc.).

Laurentian Bank PSIP direct debits allow you to save year-round and at your own pace, helping you reach your savings goals and achieve what’s important to you.

Fictional example provided solely for information purposes, based on an investment in mutual funds.

+ Discover our plans

Plans tailored to your savings goals

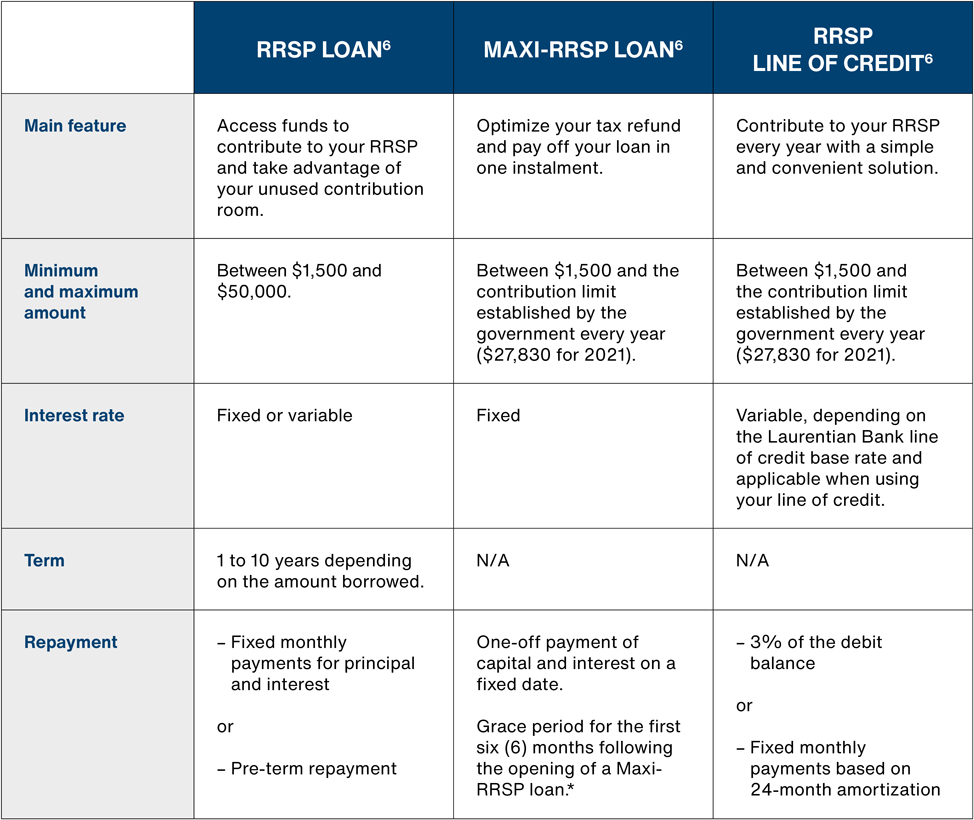

RRSP FINANCING

RRSP loan, Maxi-RRSP loan, RRSP line of credit

Borrowing funds to invest can be a great option to help you save.

You can use these funds to contribute to your RRSP or to make up your unused contribution room.

Discover the benefits of using RRSP financing to reach your retirement savings goal faster.

Benefits:

- Boost your RRSP contributions

- Enjoy tax-free investment income, generally up until the time of withdrawal

- Reduce the amount of payable tax

- Take advantage of your unused contribution room

- Reach your goal faster

- Benefit from an advantageous interest rate

+ Compare our RRSP financing solutions

The ABCs of saving

Want to save more to reach your savings goals? Whether you’re looking to retire, build an emergency fund, buying a home or completing a project, here are a few tips to help you get there faster.

+ Why saving matters

- Achieve your goals (retirement, travel, buying a home, etc.)

- Enjoy peace of mind knowing you have the funds to handle the unexpected (losing a job, major home repairs, etc.)

- Avoid going into debt

- Save money (avoid lending fees, reduce income tax, etc.)

+ When to start saving

The sooner you start saving, the better off you’ll be. So stop putting it off till tomorrow and start saving today!

+ How to get there

- Step 1: Commitment

Meet with an advisor to complete your financial health assessment. This is a useful tool that will give you an overview of your financial health. This way, you can find out where to start and take advantage of personalized advice to help you save. - Step 2: Regularity

With an advisor, identify your savings goals and horizons (short, medium or long term). Then determine the amount and maturity date for each of your goals. - Step 3: Discipline

Revise your savings strategy annually or when a life event is likely to impact your finances (retirement, separation, a new baby, health issues, etc.).

+ How much to save

Make sure your savings goal is realistic and attainable.

You’ll quickly see that it’s possible to save without having to deprive yourself day to day.

Tips to reach your savings goal faster

- Meet with an advisor and take advantage of personalized advice.

- Save periodically, making automatic payments to a dedicated savings account.

- Invest a portion of your additional earnings (work bonus, inheritance, tax refund, etc.).

- Don’t leave money sitting in an account when it could be invested.

- Let your savings grow so you can make a profit.

- Invest your savings to take advantage of certain tax benefits1 (RRSP, TFSA, etc.)

- Reduce your taxable income with an RRSP and take full advantage of social programs (family allowance, tax credits, etc.).

Tips

Take stock of your finances

This is the starting point for good financial health.Here are some tips to help you get there. We suggest you complete this exercise before meeting with an advisor.

+ Discover the tips

- Create or update your budget to figure out where your money is going. That way, you will be able to control your expenses to start saving better. Use a budget table to simplify your life.

- Make a list of your assets (property, belongings, bank accounts, investments, etc.) and liabilities (loan, mortgage, line of credit, etc.). An advisor will calculate your net worth (your assets minus your debts) and make recommendations accordingly.

- Gather your documents (income tax return, federal notice of assessment, statements of your assets and debts, powers of attorney, insurance contracts, statement of participation in the QQP, etc.). Your advisor will let you know which documents to bring.

- Think about your objectives (the reasons you want to meet with an advisor) and the timeframe for achieving them.

- Complete or review your financial health assessment with an advisor. This exclusive Laurentian Bank tool will give you a detailed report of your financial needs.

Taking stock of your finances is easier than you think.

If you need help updating your budget or calculating your assets and debts, our advisory team is here to help you.

Know your investor profile

Understanding your financial situation and habits will help you invest better.

Knowing your investor profile will allow you to determine your risk tolerance and find the asset and investment mix that works best for you.

+ Factors to consider

- Your personal goals

- Your investment horizon

- Your personal situation

- Your financial situation

- Your risk tolerance level

- Your age

Your investor profile may change over time depending on the factors above. We recommend that you review your investor profile annually or when one or more of these factors are subject to change.

Diversify your investments

Three reasons why you should diversify your portfolio:

- It’s not optimal to get a return on your different investments at the same time.

- Economic conditions may vary (interest rates, exchange rates, inflation rates).

- Not all investments have the same level of risk.

+ Learn more

The goal of diversifying is to spread out the risk, choosing different investments to protect your savings against market fluctuations without sacrificing potential returns. If certain investments don’t generate the expected return, other investments can compensate, allowing you to balance out your losses and gains.

The keys to a diversified portfolio:

- Invest in several asset categories: cash, fixed income securities, equities. Choose the allocation that best fits your investor profile.

- Put your money in investments with different risk levels: low, medium, high, etc.

- Diversify your investments geographically: Canadian, American and international, to benefit from the strengths of different markets.

Calculators

Some articles to read

Useful links

Make an appointment with an advisor

Take advantage of our extended opening hours and meet with an advisor to contribute to your RRSP.

Legal notice

Home Buyer’s Plan

Registered Retirement Savings Plan

Lifelong Learning Plan

Tax-Free Savings Account

Existing investment accounts are offered by Laurentian Bank of Canada (“Laurentian Bank”) or LBC Financial Services Inc. (“LBCFS”). Mutual funds are distributed by LBCFS. LBCFS is a wholly-owned subsidiary of Laurentian Bank and a separate legal entity from Laurentian Bank, B2B Trustco and all other issuers or mutual fund companies whose products it distributes. Newly opened investment accounts must be LBCFS accounts. A Laurentian Bank advisor is also a licensed LBCFS mutual fund representative. LBCFS’s liability is limited to the conduct of its representatives in the performance of their duties for LBCFS.

- RRSP: You can withdraw from your RRSP at any time. However, the amount withdrawn will be added to taxable income, and withholding tax will be made upon withdrawal. Amounts invested in an RRSP can be deducted, up to the annual allowable limit. Investment earnings in an RRSP are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to an RRSP until the end of the year in which you reach the age of 71; it must then be converted. For more information on your RRSP contribution rights, please consult the Canada Revenue Agency.

TFSA: You can make a withdrawal from your TFSA at any time, with no withdrawal tax. Amounts invested in a TFSA are not deductible. Investment earnings in a TFSA are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to a TFSA throughout your lifetime without the need to convert it to another type of account. For more information on your TFSA contribution rights, please consult the Canada Revenue Agency. - Mutual funds are distributed by LBC Financial Services Inc. (“LBCFS”), a wholly-owned subsidiary of Laurentian Bank of Canada (“Laurentian Bank”). LBCFS is a legal entity distinct from Laurentian Bank, B2B Trustco, Mackenzie Financial Corporation (Mackenzie Investments), and from all other issuer or mutual fund companies whose products it distributes. Each licensed LBCFS representative is also a Laurentian Bank of Canada employee. The liability of LBCFS is limited to the conduct of its representatives in the performance of their duties for LBCFS. Important information is contained in the relevant fund facts. We ask that you read this (these) document(s) carefully prior to investing. For more information with regards to the funds traded, please refer to the funds simplified prospectus. To obtain your copy of the fund facts and/or simplified prospectus concerning the fund(s) you have chosen, please contact a LBCFS representative at the Bank branch. Investing in a mutual fund (“fund”) may result in sales and trailing commissions, management fees, administration fees and other fees. The funds available through LBCFS are not insured by the Canada Deposit Insurance Corporation, Canadian securities regulators, or any other public deposit insurer. In addition, mutual funds are not guaranteed in whole or in part by Laurentian Bank, B2B Trustco, or any other entity. There is no guarantee that a fund will maintain a constant value per unit, or that you will recover the full amount invested in a fund. Funds often fluctuate in value, and past performance is not an indicator of future performance.

- Some conditions apply. GICs are not cashable. Simple interest is paid on terms of less than two years. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. This product is eligible for registered and non-registered plans. This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC) up to the maximum limit for coverage from the CDIC and subject to applicable conditions. This offer cannot be combined with any other offer. Additional information can be obtained by calling 1-844-494-0076, or by contacting your advisor.

- Existing investment accounts are offered by Laurentian Bank LBCFS.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. GICs are not cashable. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. This product is eligible for registered and non-registered plans. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. For more information, including offer terms and conditions, are available in a Quebec branch or on the Guaranteed Investment Certificates page of our website.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. This offer is only eligible for new TFSA and RRSP contributions, as well as for transfers of funds from other financial institutions to TFSA or RRSP plans at Laurentian Bank of Canada. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank of Canada investment product are not eligible for this offer. Cashable without penalty after 30 days. Simple interest is calculated and paid at maturity. For more information, including offer terms and conditions, are available in a Quebec branch or on the Term Deposit page of our website.

Legal notice

Laurentian Bank of Canada

Tax-Free Savings Account

Guaranteed Investment Certificates

Term Deposit

Lifelong Learning Plan

Home Buyer’s Plan

Registered Retirement Savings Plan

The content of this website is for information purposes only and must not be interpreted, considered or used as if it were financial, legal, fiscal or other advice. It does not create any legal or contractual obligation for LBCFS, Laurentian Bank or their affiliates. They cannot be held liable for any damages or losses that may arise from any errors or omissions in its content or from any actions or decisions taken in reliance on such content.

Existing investment accounts are offered by Laurentian Bank or LBCFS. LBCFS is a wholly-owned subsidiary of Laurentian Bank and a separate legal entity from Laurentian Bank, B2B Trustco and all other issuers or mutual fund companies whose products it distributes. Newly opened investment accounts must be LBCFS accounts. A Laurentian Bank advisor is also a licensed LBCFS mutual fund representative. LBCFS’s liability is limited to the conduct of its representatives in the performance of their duties for LBCFS.

- RRSP: You can withdraw from your RRSP at any time. However, the amount withdrawn will be added to taxable income, and withholding tax will be made upon withdrawal. Amounts invested in an RRSP can be deducted, up to the annual allowable limit. Investment earnings in an RRSP are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to an RRSP until the end of the year in which you reach the age of 71; it must then be converted. For more information on RRSP and your RRSP contribution rights, please consult the Canada Revenue Agency.

TFSA: You can make a withdrawal from your TFSA at any time, with no withdrawal tax. Amounts invested in a TFSA are not deductible. Investment earnings in a TFSA are sheltered from tax. If your annual contribution is less than your allowable limit, the difference will automatically be carried forward to a subsequent year, and can be done so indefinitely. The law allows you to contribute to a TFSA throughout your lifetime without the need to convert it to another type of account. For more information on TFSA and your TFSA contribution rights, please consult the Canada Revenue Agency. - Mutual funds “funds” are distributed by LBCFS, a wholly-owned subsidiary of Laurentian Bank. Important information is contained in the relevant fund facts. For more information with regards to the funds traded, please refer to the funds simplified prospectus. Please read this (these) document(s) carefully and consult your advisor prior to investing. To obtain your copy of the fund facts and/or simplified prospectus concerning the fund(s) you have chosen, please contact a LBCFS representative at the Laurentian Bank branch. Investing in a fund may result in sales and trailing commissions, management fees, administration fees and other fees. The funds available through LBCFS are not insured by the Canada Deposit Insurance Corporation, Canadian securities regulators, or any other public deposit insurer. In addition, mutual funds are not guaranteed in whole or in part by Laurentian Bank, B2B Trustco, or any other entity. There is no guarantee that a fund will maintain a constant value per unit, or that you will recover the full amount invested in a fund. Funds often fluctuate in value, and past performance is not an indicator of future performance.

- Some conditions apply. GICs are not cashable. Simple interest is paid on terms of less than two years. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. This product is eligible for registered and non-registered plans. This product is eligible for deposit insurance from the Canadian Deposit Insurance Corporation (CDIC) up to the maximum limit for coverage from the CDIC and subject to applicable conditions. This offer cannot be combined with any other offer. Additional information can be obtained by calling 1-844-494-0076, or by contacting your advisor.

- Some conditions apply. The final rate of return of a Laurentian Bank Blue Chip ActionGIC is calculated based on the performance of the reference index between the issue date and the maturity date of the investment. The value at maturity is obtained by calculating the average value of the index at closing, on the three dates for the calculation of the reference index as specified in the purchase agreement. The final return of the reference index is determined by calculating the sum of the return for each share in the reference index during the period divided by the number of shares making up the reference index. Since the rate of return of this investment depends on the performance of a reference index comprised of securities, any fluctuations in the reference index will affect the investment’s final rate of return. Past performance is not an indicator of future performance. If the total return obtained is negative or nil, the invested capital is fully guaranteed and will be remitted upon the investment’s maturity, but no interest will be paid out. If the total return obtained is positive, the invested capital and interest (up to the maximum rate of return set on the issue date) will be paid out upon the investment’s maturity, since the return will be known only at that time. This investment is eligible for a non-registered or a registered plan such as an RRSP, RRIF or TFSA. A minimum investment of $500 is required. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible. For more information are available in a Quebec branch or on the Blue Chip ActionGIC page of our website.

- Some conditions apply. This offer may be modified, suspended or withdrawn at any time without notice. GICs are not cashable. Clients have a choice of simple or compound interest on terms of two years or more. Simple interest is calculated and paid annually. Compound interest is calculated and capitalized annually, and paid at maturity. This product is eligible for registered and non-registered plans. Individuals residing outside of Quebec who do not currently hold a Laurentian Bank investment product are not eligible for this offer. For more information, including offer terms and conditions, are available in a Quebec branch or on the Guaranteed Investment Certificates page of our website.