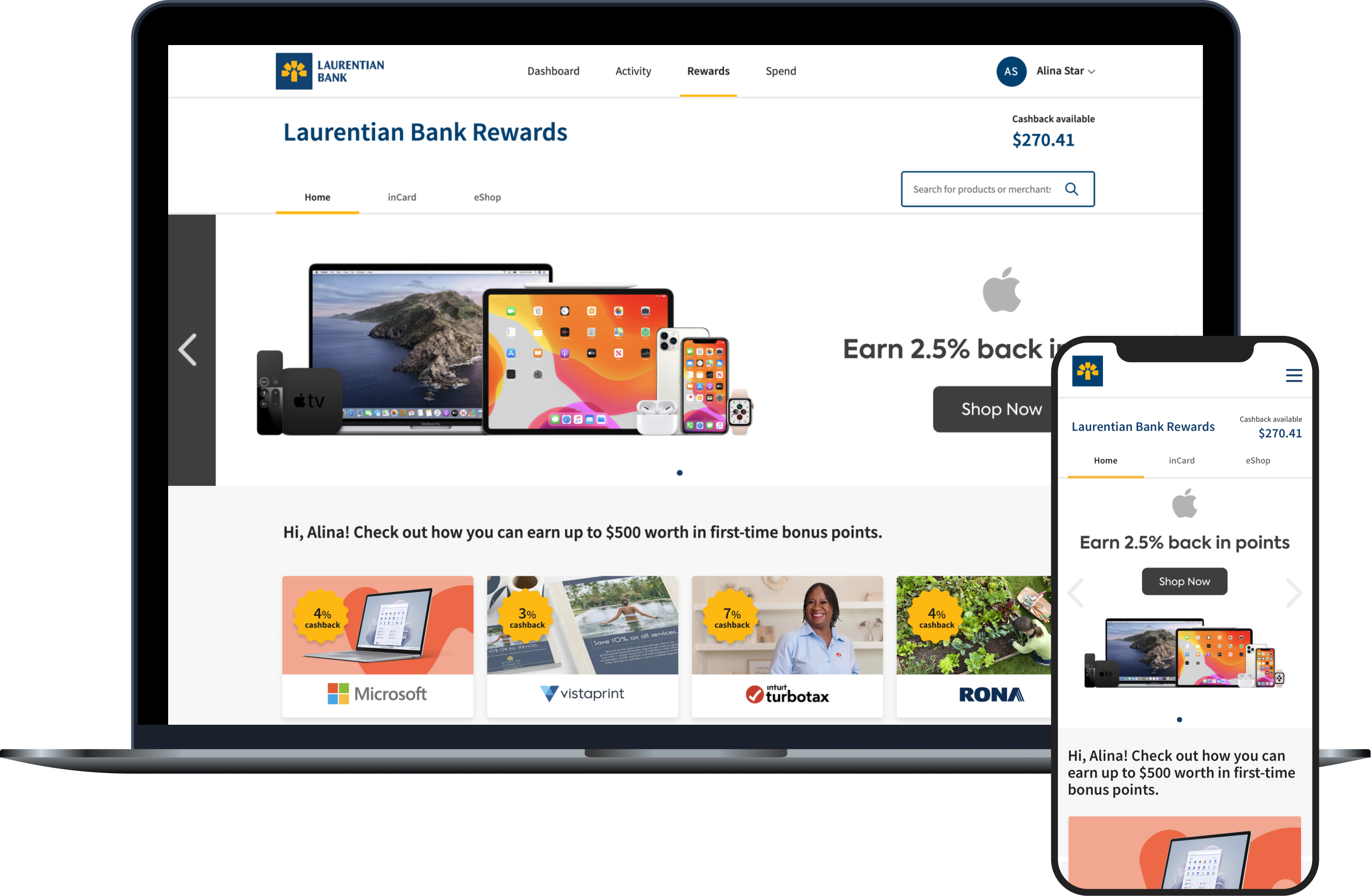

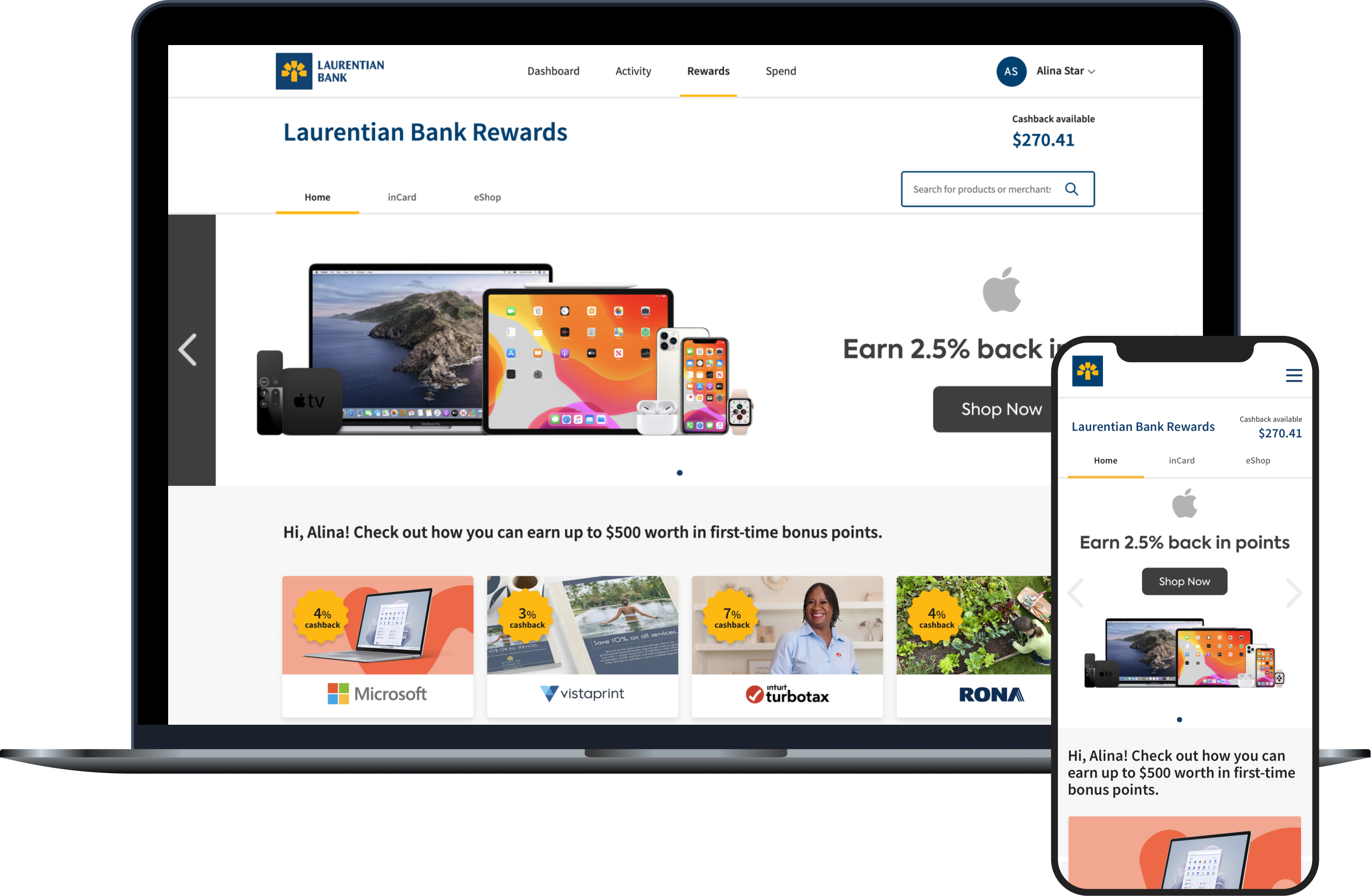

Whether you have a Business Rewards or Business Cashback Card, all Cardholders have access to the Laurentian Bank Rewards Program. New merchant partners are onboarded regularly with offers that are both global and local in scale that enhance your rewards. All Cardholders can earn company rewards throughout the cycle.

Two Types of Offers Available:

-

InCard rewards are bonus rewards offered automatically in real time when you pay with your Laurentian Bank credit Card. The purchases can be made online or at a partner merchant location.

Note: To be eligible for these offers, you must use your Laurentian Bank Visa Business Credit Card to make the purchase.

-

eShop rewards are bonus rewards offered when you make purchases online in the "Rewards" section of your Laurentian Bank Visa Credit Card Login.

To do so, you must:

Select the accompanying shopping link located on the eShop page to be directed to a retailer’s website and successfully complete a purchase while your session is active.

Note:Sessions are valid for three (3) hours from landing on the merchant’s page. Only items added to online shopping carts after a session begins may be eligible for the eShop offer. Navigating to other websites after starting a session may void your eligibility. Offer details may change from time to time.

How do Laurentian Bank Visa Rewards work?

- All rewards accumulated by Cardholders are centralized and applied to the company’s account.

- Your accumulated rewards are automatically converted and applied to the Account Balance each month when the statement is produced.

There are different ways you can earn rewards:

Laurentian Bank Visa* Business Rewards

The Points Program is based on a points accumulation system tied to the amount of eligible Net Purchases made through the Bank’s Rewards program offered by merchants and charged to the Account during the billing cycle. Points are earned for every dollar on eligible Net Purchases made with the Card through our Rewards program offered by merchants.

Laurentian Bank Visa* Business Cashback

The Cashback Program is based on a cash back reward accumulation system tied to the amount of eligible Net Purchases charged to the Account during the billing cycle, including those made through our Rewards program offered by merchants. The cash back earned will depend on the total amount charged and posted to the Account during the billing cycle.

- First $3,000 charged and posted to the Account during the billing cycle: 0.75% cash back for every dollar on eligible Net Purchases charged and posted to the Account.

- Any amount above $3,000 charged and posted to the Account during the billing cycle: Additional 0.50% cash back for every dollar on Net Purchases charged and posted to the Account.

As a Visa account signatory, you will have an Administrator or Primary Cardholder role.

You will be able to:

- View all Cardholders in the company

- See the company’s Account Balance

- See Credit limits and available credit

- Make a payment

- View your rewards balance (points or cashback)

- View and download monthly Account Statements

- View inCard and eShop offers

- Update company information

- View your and your Cardholders’ transactions

- Change Cardholders’ Spending Limits

- Lock/unlock your Card or those of Cardholders

- Change your PIN

- Manage notifications about Cardholders

- Manage payment and Credit Limit notifications

- Manage travel notices

- Update your personal information and that of Cardholders

- Report your or a Cardholder’s card as lost or stolen

- Activate your Card

- View your Card details and those of Cardholders

- Remove a Cardholder

- Configure, modify or cancel Autopay

As a Cardholder (Authorized User)

You will be able to:

- View your card’s transactions and available Spend Limit

- View inCard and eShop offers

- Lock/unlock your Card

- Change your PIN

- Manage your Card's purchase notifications

- Manage travel notices for your Card

- Update your personal information

- Report your lost or stolen Card

- Activate your Card

- View your Card details.

Please note that access to the various features within the Credit Card Login depends on your role within your company (primary Cardholder, administrator or Cardholder). For more details, please refer to the document concerning roles.

We invite you to take a look at the important information concerning the Laurentian Bank Visa Business Credit Cards and Login.

When will I receive my Card?

Your Card will be sent to your company address within 5-7 business days.

How can I activate my Card?

- You can activate your Card online by simply scanning the QR code provided in the letter accompanying the new Card. You can use your mobile device’s camera to scan the code, and then, follow the instructions provided. You can also proceed with the activation directly online. Remember to consult our activation guide if you require assistance.

-

You can also activate your Card via telephone by following the steps below:

- Dial 1-866-960-4120.

- Enter your 16-digit credit Card number.

- Enter your birthdate and press the “#” key (YYYYMMDD#).

- Enter the expiry date indicated on your Card and press the “#” key (MMYY#).

Your Card is now activated. Please remain online to configure your PIN:

- Press “1” to access the menu.

- Press “5” to modify the PIN.

- Select your PIN and press “#” (PIN#).

- Confirm your PIN and press “#” (PIN#).

What can I expect when making my first purchase?

On your next purchase, you may need to insert your Card into a payment terminal and enter your new 4-digit PIN. You’ll be asked to enter your new PIN 3 times. Each time you enter the PIN, the message “Incorrect PIN” will appear. Don’t worry, just continue until you receive a confirmation. After your third and final attempt, your PIN will be synced to your Card and you can continue to use your Card as usual.

Do I have access to the platform if I am an account signatory but do not hold a Card?

When logging into your Administrator profile, you will be asked to verify your identity using your mobile phone number. If you experience issues, it may be because we do not have your current mobile phone number in our records. For assistance, please contact the Telebanking Centre at 1-800-522-1846, or your business centre coordinator.

What is a security alert and how do I benefit from it?

- Laurentian Bank security and fraud prevention alerts are text notifications sent from the abbreviated number “27460”. They are generated when a transaction linked to your Visa account appears to be unusual.

- Thanks to your credit Card, you have complimentary access to our fraud prevention service. To maximize your protection, simply add your mobile number to your profile in order to be sure to receive our fraud alerts in real time.

How do I proceed if I am an account holder and I wish to modify my statement preferences?

• By default, your statements will be issued electronically. As an account holder, if you prefer to receive a paper statement, you can select that option in the “My Account” section of your Credit Card Login. Paper statements will be forwarded to the company address, to the attention of the primary contact indicated on the account.

Legal Notice

*Trademark of Visa Int., used under license.

Capitalized terms not defined in this page have the meaning ascribed to them in the Agreement Governing the Use of the Laurentian Bank Visa* Business Card, as updated.

- Digital features available via the Credit Card Login are subject to the user’s access level.

- The bank displays the transactions in the order in which the merchant posts them. However, there may be a change in the order in which transactions appear. We recommend you check the timestamp of the transaction to verify if the transaction is out of order.

- For full details on the terms and conditions that apply to the Rewards Program, please refer to the Business Rewards Program Agreement.