Mutual Funds

|

LBCFS is the exclusive distributor of the Laurentian Bank Group of Funds. |  |

LBC Financial Services offers a range of Laurentian Bank mutual funds through Mackenzie Investments ("Mackenzie"), one of Canada’s largest investment management firms. Available exclusively to our clients, our funds are designed to fit a large type of investors, from the most cautious to the most adventurous.

+ What is a mutual fund?

When directed by expert portfolio managers, mutual funds offer a potentially unlimited return. However, your capital is not guaranteed and your return may vary depending on market fluctuations.

The key is to invest with a medium or long-term outlook, and to avoid putting all your eggs in one basket.

The money you invest in a mutual fund is pooled with other investors’ money to acquire a group of individual stocks. The portion of the return on the fund that you receive equals the portion of the fund that you bought.

+ Advantages of mutual funds

Each fund is managed according to specific investment goals. Mutual funds offer numerous advantages:

- Investing is a simple process.

- Funds are directed by veteran portfolio managers.

- An enormous variety of funds is available to meet all preferences and needs.

- The variety of investments lets you diversify your portfolio, maximizing your potential return while helping minimize risk.

+ Discover ESG funds

Our world is changing and moving towards a shared willingness to commit to change. Protecting our planet, living in a more fair and inclusive society, striving for a better future for ourselves and future generations. The popularity of responsible investment is not a passing trend. For more than a decade, and now more than ever, Canadians have become aware that their investment choices can positively impact their finances and the planet, and are seeking to diversify their portfolios with sustainable investment solutions that reflect their values, such as ESG mutual funds (funds).

ESG criteria

Based on an in-depth analysis of the companies they hold, their specific risk management approach and the integration of environmental, social and governance (ESG) criteria in investment decisions, ESG funds are a great solution for those wishing to become responsible investors. They are aimed both at new and more seasoned investors who want to create positive change and enjoy competitive returns over the medium to long term.

| Environmental | Social | Governance |

|---|---|---|

|

|

|

Find out more about responsible investing on our partner Mackenzie’s website.

LBC Financial Services offers its investors eight ESG mutual funds and three ESG model portfolios.

+ ESG mutual funds

This fund has the potential for moderate capital growth and reduced volatility. It consists of concentrated investments in fixed income securities from issuers located anywhere in the world. Sustainable bonds are designed to finance projects that will help make the world a better place.

Mackenzie Global Sustainable Bond Fund

This fund seeks to generate income and the potential for long-term capital growth through an investment approach that focuses on sustainable and responsible issuers. Comprising a broad range of fixed income securities from companies located anywhere in the world, the fund invests primarily in the environmental sector with a focus on 'green' bonds.

Mackenzie Betterworld Canadian Equity Fund

This fund has the potential for competitive long-term capital growth. Its investment management strategy is designed to reduce volatility. The Fund invests primarily in equity securities of companies located in Canada that have progressive environmental, social and governance practices.

Mackenzie Betterworld Global Equity Fund

This fund has the potential for competitive long-term capital growth. Its investment management strategy is designed to reduce volatility. The Fund invests primarily in equity securities of companies located around the world that have progressive environmental, social and governance practices.

Mackenzie Greenchip Global Environmental Balanced Fund

This fund has the potential for long-term capital growth. Its management strategy is focused on the sustainable energy transition. It is composed of a combination of equity and fixed income securities from issuers located anywhere in the world.

Mackenzie Global Women’s Leadership Fund

This fund provides long-term capital growth. It features equity securities from companies around the globe that promote diversity and the representation of women in leadership positions in public companies, including in senior management teams and boards of directors.

Mackenzie Global Environmental Equity Fund

This fund seeks to generate long-term capital growth. It features stocks from companies around the globe that are active in the environmental sector and dedicated to helping fight climate change. The fund’s holdings fall into six categories: energy efficiency, clean energy, water treatment and distribution, sustainable agriculture, sustainable transportation and clean technology.

Mackenzie Global Sustainability and Impact Balanced Fund

This fund provides a balanced solution for investors who wish to invest in equity and fixed-income securities from companies and countries around the world that are willing to adopt ESG criteria or have already implemented them.

+ ESG Model Portfolios - New

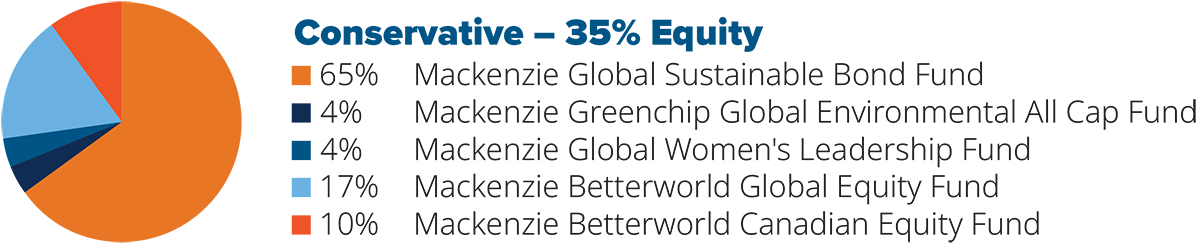

Conservative

The portfolio is comprised of 35% equities and 65% fixed income securities. It focuses on capital preservation, seeks to provide a stable income stream with some growth potential and is diversified to reduce volatility.

Balanced

The portfolio is comprised of 60% equities and 40% fixed income securities. It targets a balance between growth and capital preservation while providing diversification to reduce volatility.

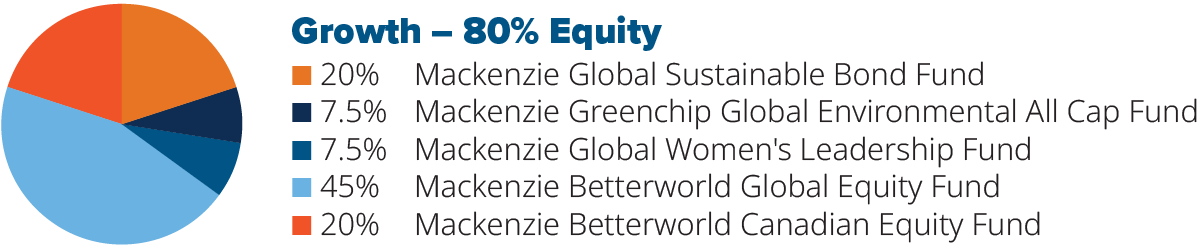

Growth

This portfolio is comprised of 80% equities and 20% fixed income securities. It focuses on growth through diversification of securities while providing a certain level of capital protection without excessive risk.

+ Symmetry portfolios: Your turnkey solution

Countless mutual funds are available on the market. All-in-one solutions such as Symmetry portfolios are designed to tolerate different levels of risk, depending on your long-term goals and your plan to achieve them while focusing on your current priorities. For each investor profile, there’s a Symmetry portfolio. These investments offer:

- A first-rate solution: Investments are managed in a way similar to a pension fund.

- Balance between protection and growth: Symmetry portfolios are broadly diversified and aim to strike a balance between protecting the capital you need today and nurturing the growth you need for tomorrow. Each portfolio is designed to provide to a wide range of investment opportunities with low levels of risk.

- Effective risk management: In monitoring investment portfolios, Mackenzie places top priority on effective risk management. Strategic portfolio weights are tactically tilted to take advantage of market conditions.

- Daily rebalancing: To keep your Symmetry portfolio in line with your risk tolerance and growth objectives, Mackenzie sets a target weighting for each portfolio. If the market fluctuates too widely, the team rebalances the weighting in stocks and bonds to bring your portfolio within your risk tolerance.

- Assets with low volatility: The asset allocation team at Mackenzie assigns a specific weighting to assets with low volatility, with the aim of delivering what every investor wants: maximum performance with minimal risk.

- Veteran portfolio managers: Mackenzie’s greatest advantage is their ability to bring together skilled investment professionals.

+ Symmetry portfolios: Overview

For investors ranging from the cautious to the adventurous, Mackenzie offers seven types of portfolios:

- ESG Model Portfolios - New

- Symmetry Fixed Income Portfolio

- Symmetry Conservative Income Portfolio

- Symmetry Conservative Portfolio

- Symmetry Balanced Portfolio

- Symmetry Moderate Growth Portfolio

- Symmetry Growth Portfolio

- Symmetry Equity Portfolio Class

- Customized portfolio

A wide range of funds is also available to build your own customized portfolio.

+ Preferred Pricing

Invest. Combine. Save.

The Preferred Pricing Service for Laurentian Bank Group of Funds, managed by Mackenzie Investments, enable you to

How to take advantage?

Mackenzie’s Preferred Pricing Service is designed to ensure that you automatically benefit from reduced costs, once $100 000 in assets (household or personal)3 held with the Laurentian Bank Group of Funds, managed by Mackenzie Investments, is reached. It’s a great reason to combine your assets!

Learn more:

Preferred Pricing Service

Understanding how management fee rebates are taxed

+ Who is LBCFS?

+ Who is Mackenzie Investments?

With 186.0B (CAD) in assets and 16 distinct investment teams, Mackenzie Investments has the strength and diversity of multiple perspectives to help you meet your clients' needs and help support them in all markets.

Legal notice

1. Mutual funds are distributed by LBC Financial Services Inc. (“LBCFS”), a wholly-owned subsidiary of Laurentian Bank of Canada (“Laurentian Bank”). LBCFS is a legal entity distinct from Laurentian Bank, B2B Trustco, Mackenzie Financial Corporation (Mackenzie Investments), and from all other issuer or mutual fund companies whose products it distributes. Each licensed LBCFS representative is also a Laurentian Bank of Canada employee. The liability of LBCFS is limited to the conduct of its representatives in the performance of their duties for LBCFS. Important information is contained in the relevant fund facts. We ask that you read this (these) document(s) carefully prior to investing. For more information with regards to the funds traded, please refer to the funds simplified prospectus. To obtain your copy of the fund facts and/or simplified prospectus concerning the fund(s) you have chosen, please contact a LBCFS representative at the Bank branch. Investing in a mutual fund (“fund”) may result in sales and trailing commissions, management fees, administration fees and other fees. The funds available through LBCFS are not insured by the Canada Deposit Insurance Corporation, Canadian securities regulators, or any other public deposit insurer. In addition, mutual funds are not guaranteed in whole or in part by Laurentian Bank, B2B Trustco, or any other entity. There is no guarantee that a fund will maintain a constant value per unit, or that you will recover the full amount invested in a fund. Funds often fluctuate in value, and past performance is not an indicator of future performance.

2. You may be able to enjoy reduced mutual fund management and administration fees.

3. You can include the assets of family members living in the same household to achieve this amount. Please notify us of the accounts to combine in order to add family members, as account householding is not automatic in all cases.

Hyperlinks on this website may redirect to an external site that is not administered by Laurentian Bank. Laurentian Bank cannot be held responsible for the content of this external site or for any damages resulting from its use. The information contained on this site has been obtained from sources believed to be reliable, but Laurentian Bank cannot guarantee its accuracy, completeness or reliability. Unless otherwise indicated, all opinions and estimates on this website are as of the date of publication and are subject to change without notice.